Pending the overhaul of the VAT rules with the implementation of the permanent system planned for 1 January 2022, the European Council approved a number of small measures to improve the current system, the “Quick Fixes”, which should come into effect as of 1 January 2020.

The second measure relates to the attachment of transport in chain transactions.

The transport attachment problem

From 2010, the Court of Justice of European Union has consistently held that when a good is the subject of several successive deliveries giving rise to only one intra-Community transport, only one of them can benefit from the exemption from VAT applicable to intra-Community supplies.

In order to determine which of the deliveries is exempt, it is first necessary to determine to which delivery the intra-Community transport is to be attached. If, in the course of its case law, the CJEU has given some suggestions concerning the attachment of transport, the proposed methods are sometimes difficult to implement and differ depending on the circumstances.

A solution proposed about transport attachment

In principle, the transport should be linked to the delivery made for the company which handles the intra-community transport of the goods.

By way of exception, the transport would be linked to the delivery made by the undertaking in charge of intra-Community transport of the goods, in the event that the latter communicates to its supplier its VAT number in the Member State of departure.

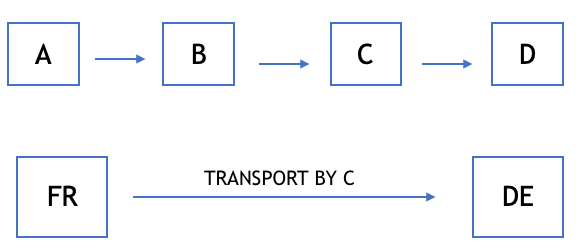

All other transactions of the chain would be local deliveries, localized:

- in the Member State of departure for those intervening before intra-Community

- in the Member State of arrival for those intervening after intra-Community

In this scheme, it is the company C which takes care of the transport.

Thus, intra-Community delivery would in principle be between B and C. However, intra-Community delivery would be between C and D in the event that C communicates to B his French VAT number.

You can now contact the ASD Group experts to discuss their issues and let them accompany you.