From 1 July 2024*, businesses subject to VAT will be legally obliged to provide electronic invoices. This article explains how you can implement electronic invoicing with complete peace of mind, so that you’re ready in advance.

* Warning: postponement France: General introduction of electronic invoicing scheduled for July 2024 postponedWhat is an electronic invoice?

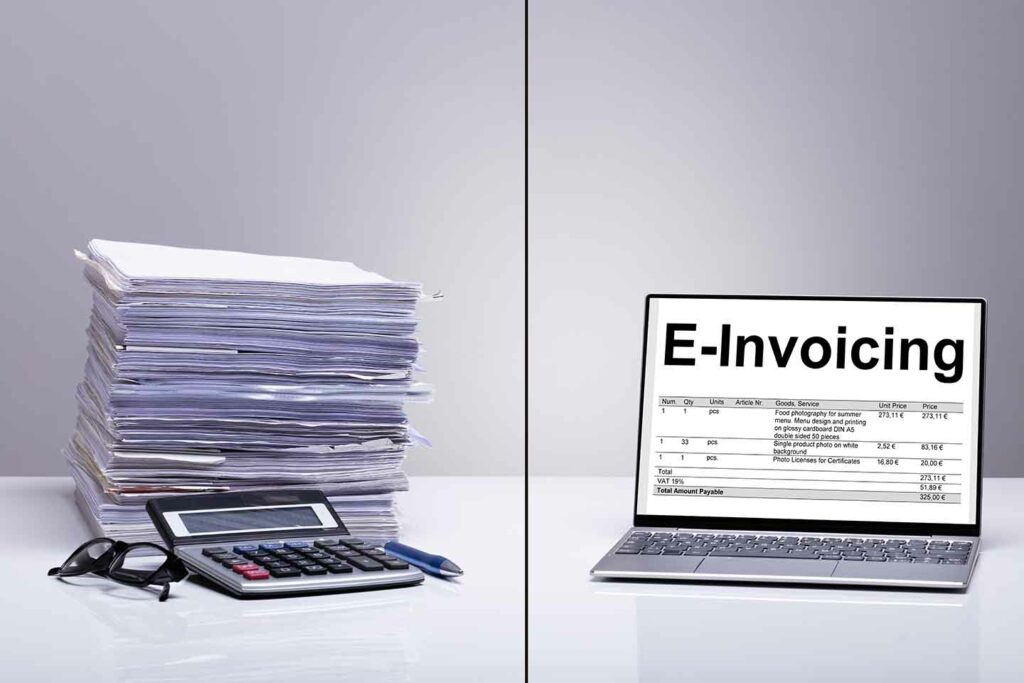

An electronic invoice, also known as an e-bill, is an invoice that does not require a paper medium.

Read more on the same subject:

France: Introduction of electronic invoicing and E-reporting of VAT from 1 July 2024

Who is affected by electronic invoicing?

Electronic invoicing concerns a number of economic players in France. Here are the main ones concerned:

- Businesses: All businesses, whatever their legal status or size, are affected by electronic invoicing. They must be able to issue and/or receive electronic invoices, in accordance with the legal obligations applicable to them.

- Public entities: Public entities, such as public administrations, local authorities, public establishments, etc., are also concerned by electronic invoicing. They must be able to receive electronic invoices issued by their suppliers and business partners.

- Electronic invoicing service providers: Service providers specialising in electronic invoicing offer technical solutions and platforms enabling companies to issue and receive electronic invoices that comply with legal standards and the required formats.

It is essential that the players involved familiarise themselves with the legal obligations relating to electronic invoicing and take the necessary steps to comply with these requirements.

What changes will the adoption of electronic invoicing bring?

Mandatory electronic invoicing for business-to-business (B2B) transactions simplifies the processing of incoming and outgoing invoices and the filing of VAT returns.

- Incoming invoices can be easily integrated into companies’ accounting systems.

- Outgoing invoices can be checked for conformity in advance, enabling non-compliant invoices to be rejected immediately.

- Customers can easily track the progress of their invoices.

What are the advantages of electronic invoicing?

Cost reduction

Electronic invoicing can reduce the cost of processing and sending paper invoices, as well as the cost of manually managing payments and invoices.

Time saving

Electronic invoicing reduces the time taken to process invoices, from issue to receipt, as well as the time taken to manage disputes and errors.

Increased reliability

Electronic invoicing provides better traceability and reduces the risk of errors or lost invoices. What’s more, electronic exchanges are protected by security and authentication systems.

Respect for the environment

Electronic invoicing reduces paper consumption and the CO2 emissions associated with printing and sending paper invoices.

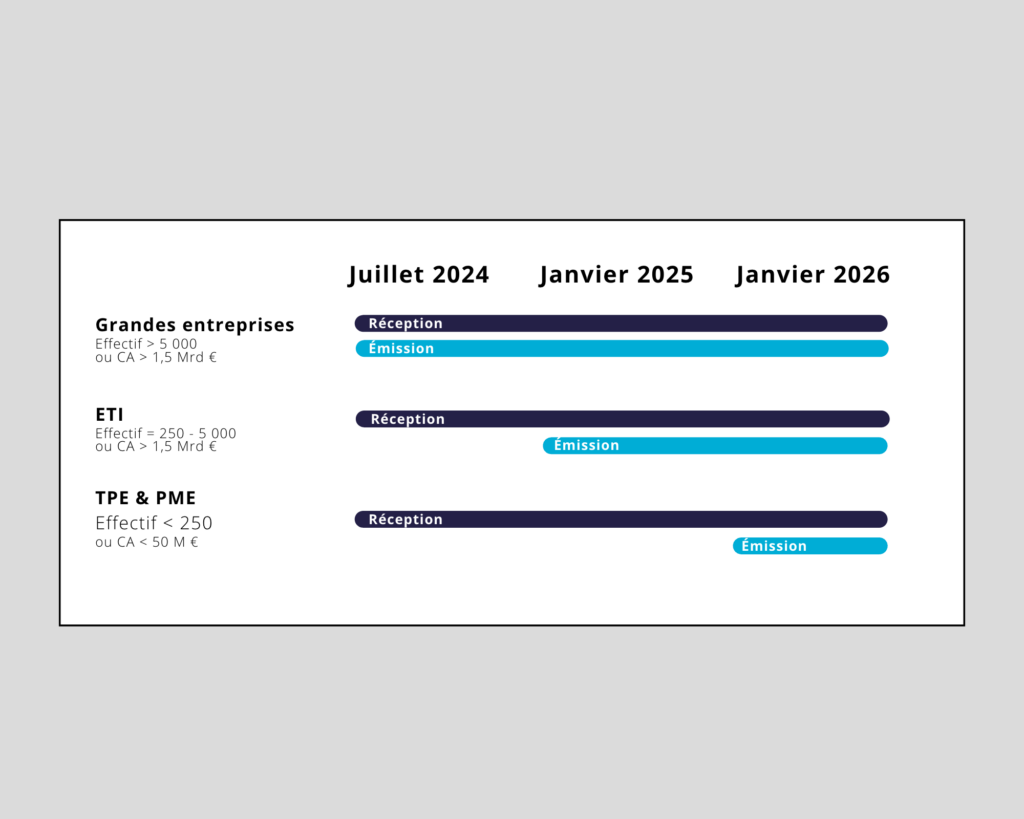

What is the timetable* for the introduction of electronic invoicing?

The timetable for implementing the reform has been drawn up to enable all types of businesses and their partners (such as software publishers and workflow platforms) to prepare effectively.

Read more on the same subject:

France: Government proposal for mandatory electronic invoicing as of 2024

What do you need to do in 2023 to prepare for electronic invoicing?

Here are the main actions that companies should consider implementing in 2023 to prepare for the transition to compulsory electronic invoicing in France from 1 July 2024* :

Identify the company’s current invoicing processes

Companies need to take stock of their invoicing processes in order to identify which processes are likely to be affected by the switch to electronic invoicing.

Training

It is important that the people involved in the invoicing process are trained in electronic invoicing and the IT tools to be used.

Identifying an electronic invoicing service provider

Companies must select an e-invoicing service provider that complies with the norms and standards in force in France.

Adapting your information system

Companies need to adapt their information systems so that they can issue electronic invoices that comply with legal and tax requirements.

Testing the system

The company must test the electronic invoicing system before the date on which the obligation comes into force to ensure that everything is working properly.

Communicating with business partners

The company needs to communicate with its business partners to ensure that they are also ready for the switch to electronic invoicing.

Setting up an archiving solution

Companies need to put in place an electronic archiving solution that complies with current regulations to ensure that electronic invoices are retained over the long term.

How do you get your customers to accept electronic invoicing?

To make it easier for your customers to accept electronic invoices, here are a few practical tips:

- Proactive communication: Inform your customers in advance of your transition to electronic invoicing. Explain the advantages of this method of invoicing, such as reduced costs, faster processing and simplified administration. Respond to any questions or concerns they may have.

- Training and support: Offer your customers personalised training or support to help them understand and use e-invoicing effectively. Make resources such as user guides, tutorials or instructional videos available to them.

- Format and channel options: Offer different e-invoicing format options, tailored to your customers’ preferences and technical capabilities. Offer invoices in PDF, XML or EDI format, for example. Make sure you also offer several transmission channels, such as online platforms, secure e-mail or dedicated portals.

- Customisation: Try to adapt the electronic invoice to your customers’ preferences in terms of structure and content. Respect any specific requirements of each customer in terms of numbering, data to be included or file formats.

- Technical support: Provide reactive technical support to help your customers resolve any technical problems or difficulties encountered when using e-invoicing. Respond quickly to their requests for assistance and propose appropriate solutions.

- Additional benefits: Highlight the additional benefits of e-invoicing, such as the ability to access a full invoice history online, simplified payment management or reduced processing errors.

By implementing these measures, you can encourage your customers to accept and adopt electronic invoicing, by offering them appropriate support and highlighting the benefits.

In conclusion, it’s essential to start preparing now for the mandatory introduction of electronic invoicing in France from 2024*. By anticipating these changes, you can ensure that you comply with current legislation and facilitate your commercial transactions.

Don’t let this change take you by surprise, and ensure the continuity of your business activities by complying with the legal requirements.

At ASD Group, we are already preparing for our customers by implementing all the necessary measures to facilitate the transition to electronic invoicing. Do not hesitate to contact our experts for more information.

The contents of this page are for information purposes only and do not constitute legal, financial or tax advice. For specific advice applicable to your business, please contact ASD Group.