On January 1st, 2020 the current VAT system will be improved by the introduction of the “Quick Fixes”, series of small measures that will enter into force in all EU member states, while awaiting the implementation of the Definitive VAT System on 1 July, 2022.

The 4 following topics will be affected by the reforms:

- Two new substantive conditions for the VAT exemption applicable to intra-Community supplies;

- Harmonized but stricter rules to prove the intra-Community transport of goods;

- Harmonized rules for ascribing transport in chain transactions;

- Harmonized rules for simplification measure for Call-off Stocks.

Let’s review topics #3 and #4 below with the infographic designed by our experts:

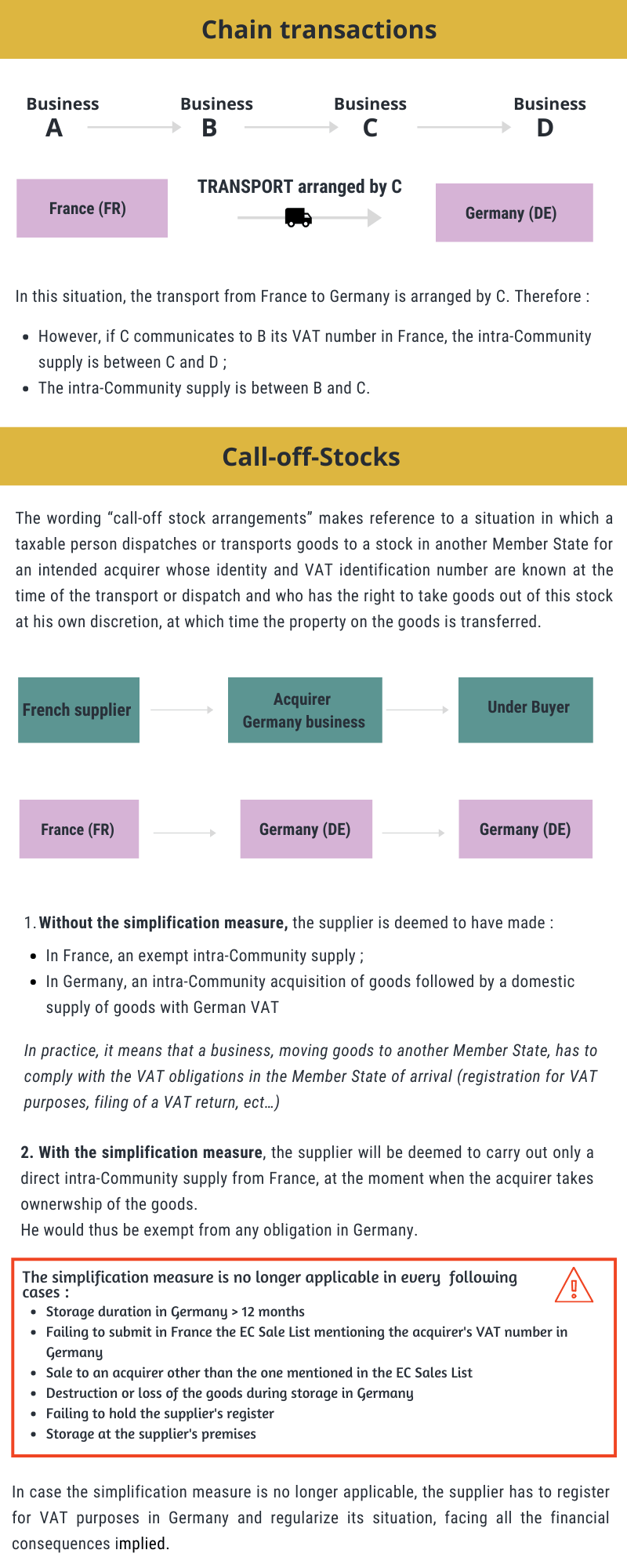

Harmonized rules for ascribing transport in chain transactions

The CJEU (Court of Justice of the European Union) considers that when goods are the subject of several successive supplies between different taxable persons, but of a single intra-Community transport, only one supply can benefit from the VAT exemption applicable to intra-Community supplies.

In order to determine which supply is exempt, it is first necessary to determine to which supply the intra-Community transport can be ascribed. CJEU has given some pointers concerning the ascribing of transport, but the proposed methods are sometimes difficult to apply and differ depending on the circumstances.

At present, the VAT Directive does not specify how the transport should be ascribed. There is therefore great differences between the Member States and too much room for maneuver left to tax administrations to determine which supply can benefit from the exemption.

As of 1 January 2020, the transport will, in principle, be considered as ascribed to the supply made for the person who arranges the intra-Community transport.

By derogation, the transport will be regarded as ascribed to the supply made by the person who arranges the intra-Community transport, in the case where this person communicates to his supplier his VAT number in the Member State of departure.

All other transactions of the chain would be domestic supplies, located :

- in the Member State of departure for those intervening before the intra-Community supply.

- in the Member State of arrival for those intervening after intra-Community supply.

Warning : a supplier who issues the invoice without VAT whereas the transport cannot be ascribed to the his supply is exposed to a VAT adjustment in case of tax audit.

Example

- In this situation, the transport from France to Germany is arranged by C. Therefore:

- The intra-Community supply is between B and C;

- However, if C communicates to B its VAT number in France, the intra-Community supply is between C and D.

Harmonized rules for simplification measure for Call-off Stocks arrangements

The wording “call-off stock arrangements” makes reference to a situation in which a taxable person dispatches or transports goods to a stock in another Member State for an intended acquirer whose identity and VAT identification number are known at the time of the transport or dispatch and who has the right to take goods out of this stock at his own discretion, at which time the property on the goods is transferred.

Under the current VAT rules, a business moving his goods from one Member State to a stock located in another Member State is deemed to have made :

- In the Member state of departure, an exempt intra-Community supply;

- In the Member state of arrival, an intra-Community acquisition of goods followed by a domestic supply of goods.

In practice, it means that a business, moving goods to another Member State, has to comply with the VAT obligations in the Member State of arrival (registration for VAT purposes, filing of a VAT return, ect…)

At present, the VAT Directive does not require the Member States to provide for a simplification measure which prevents the seller from registering in the Member State of arrival. The result is a very different application of such a measure in different Member States.

As of 1 January 2020, the VAT Directive provides for a simplification measure that is uniformly applicable across all EU Member States. By means of the simplification measure, the supplier will be deemed to carry out only a direct intra-Community supply in the Member State of departure, at the moment when the acquirer takes ownerwship of the goods. He would thus be exempt from any obligation in the Member State of arrival.

In order to use this simplification for call-off stock arrangements, certain conditions have to be fulfilled :

- both the supplier and the intended acquirer are taxable persons;

- the supplier has not established his business nor does he have a fixed establishment in the Member State to which the goods are dispatched or transported;

- the supplier records the dispatch/transport of the goods to the stock in a register;

- the goods are transported from one Member State to another with a view to being supplied there whithin 12 months after arrival to an intended customer;

- the supplier mentions the VAT identification number of the intended acquirer in his recapitulative statement (only that, not the value of the goods) submitted for the period

of the transport of the goods. - the intended acquirer is identified for VAT purposes in the Member State to which the goods are transferred;

- the acquirer’s identity and VAT identification number are known by the supplier at the time when dispatch or transport begins;

- the goods are transported from one Member State to another, thus excluding imports,

exports and supplies within a single Member State from the simplification.

To note that there are also obligations the non-fulfilment of which does not imply that the simplification could not (or no longer) be applied (although national penalties may apply). This is for example the case for the obligation of the warehouse keeper to indicate the arrival of the goods in the stock in the register to be held by him.

Warning: in the event of the expiration of the 12-month period, the destruction or loss of the goods, the change of acquirer without the resumption of the call-off stock arrangement or the transfer to another Member State, the simplification measure no longer applies and the supplier is required to register in the Member State of arrival. Otherwise, he is exposed to a VAT adjustment in case of tax audit.

It should also be noted that the simplification measure is not mandatory. The supplier may choose to apply the general scheme and register for VAT in the Member State of arrival if he wishes to do so.

Example:

- On January 10, 2020, a supplier A sends goods from France to an acquirer B in Germany who is responsible for selling the goods in his own name;

- Supplier A is established in France, without being established in Germany;

- Acquirer B is established and registered for VAT in Germany;

- A and B have agreed that the transfer of ownership will only occur when B withdraws the goods for resale.

- On February 15, 2020, acquirer B withdraws the goods for resale.

- Without the simplification measure, supplier A carries out:

- In France, a deemed intra-Community supply;

- In Germany, a deemed intra-Community acquisition followed by a domestic supply of goods subject to German VAT.

- In this situation, supplier A has to register in Germany and file periodic VAT return.

- With the simplification measure, supplier A only makes a direct intra-Community supply from France on 15 February 2020, which allows him to avoid VAT registration in Germany.However, in order to benefit from this simplification measure, supplier A must:

- Include the transfer in his DEB (Trade of Goods Declarations or Intrastat) Recapitulative Statement) submitted in France for the month of January 2020 by indicating the German VAT number of the acquirer B.

- Include the intra-Community supply in its DEB ((Recapitulative Statement) and declare this intra-Community supply in its VAT return for the month of February 2020.

- If one of the conditions is not met, the simplification measure no longer applies and the supplier is required to register in the Member State of arrival. Otherwise, he is exposed to a VAT adjustment in case of tax audit.