While awaiting the implementation of the Definitive VAT System on 1 July 2022, the European Union introduced a series of small measures to improve the current VAT system, the « Quick Fixes », which will enter into force in all EU Member States on January 1st 2020.

The reforms deal with the 4 following topics:

- Two new substantive conditions for the VAT exemption applicable to intra-Community supplies;

- Harmonized but stricter rules to prove the intra-Community transport of goods;

- Harmonized rules for ascribing transport in chain transactions;

- Harmonized rules for simplification measure for Call-off Stocks.

Let’s review topics #1 and #2 below with the infographic designed by our experts:

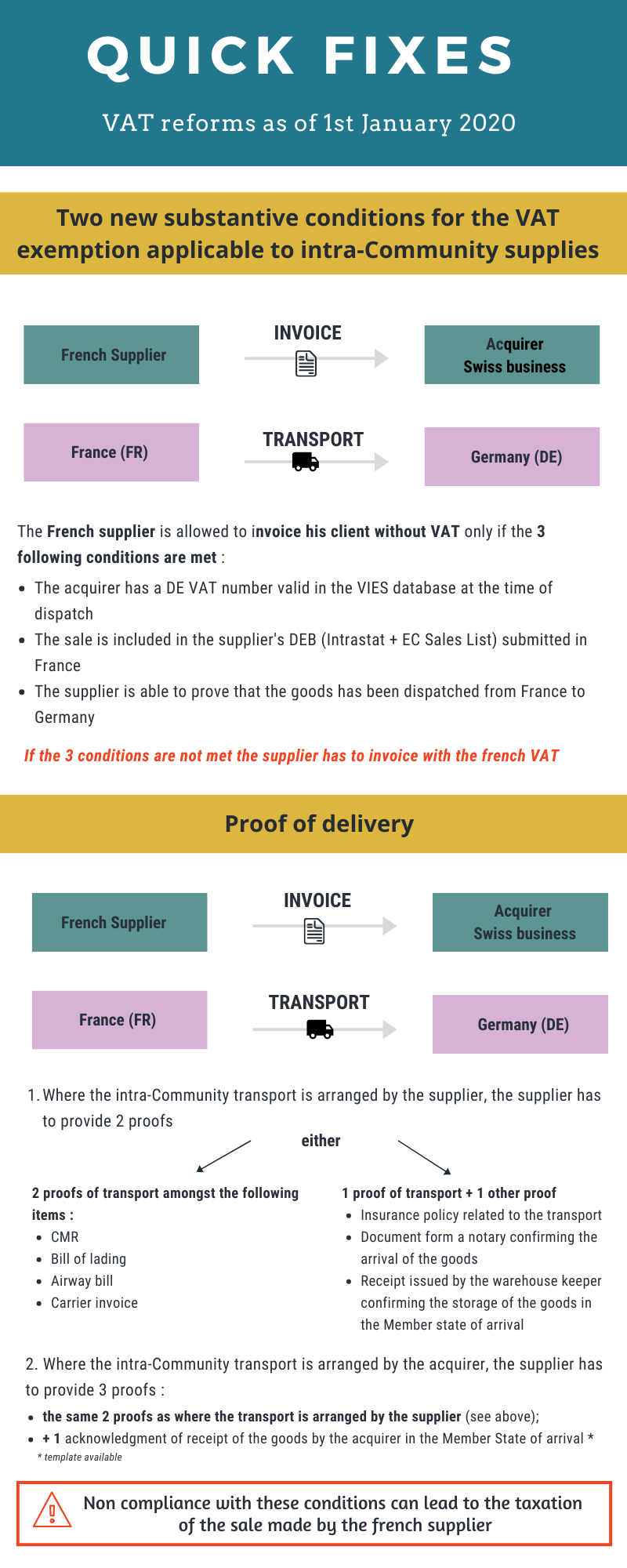

Two new substantive conditions for the VAT exemption applicable to intra-Community supplies

The registration in the VIES Database

In order to benefit from the exemption applicable to intra-Community supplies, the supplier must prove that his acquirer is a taxable person.

At present, the CJEU (Court of Justice of the European Union) that the Member States cannot refuse to grant the benefit of the VAT exemption applicable to intra-Community supplies on the sole ground that the supplier has not communicated the VAT number of the acquirer, provided that the status of taxable person of the latter is proved by other means.

As of January 1st 2020, the possession by the acquirer of a VAT number registered in the VIES database, issued by a Member State other than the Member State of departure of the transport, is a substantive condition for the benefit of the VAT exemption applicable to intra-Community supplies. This number must exist at the time of dispatch, the fact that the registration is in process is not sufficient.

In the absence of a valid VAT number of the acquirer at the time of dispatch, the supplier has to charge the VAT of the Member State of departure. If the supplier still chooses to issue his invoice without VAT, then he is exposed to a VAT adjustment in case of tax audit. Warning : the acquirer will not be able to recover the VAT, and in addition he will be exposed to a VAT adjustment in the Member State of arrival of the transport if he does not regularize his situation.

Thus, the systematic verification by the supplier of the VAT number of the acquirer on the VIES database must now become a reflex. To check your customer’s VAT number, go to the VIES database.

Important notes :

- In order for the supplier to benefit from the VAT exemption, it is not necessary that the VAT number of the acquirer has been issued by the Member State of arrival of the acquirer has been issued by the Member State of arrival of the transport.

- However, for the acquirer, it is crucial to provide his VAT number in the Member State of arrival of the transport. If the acquirer provides a different intra-Community VAT number, then he is exposed to a VAT adjustment in case of tax.

Example:

- Supplier A established in France supplies goods to an acquirer B established in Switzerland;

- The goods are dispatched by the supplier from France to

If acquirer B has a valid German VAT number at the time of dispatch, then supplier A is allowed to issued the invoice without VAT.

However, if acquirer B does not have a valid German VAT number at the time of dispatch, then supplier A has to charge French VAT. The acquirer B will not be able recover this VAT and he will be exposed to a VAT adjustment in Germany if he fails to regularize its situation.

Submitting the Recapitulative Statement

All taxable persons must submit a Recapitulative Statement (or « EC Sales List », included in the « DEB – Trade of Goods Declaration » in France).

The Recapitulative Statement includes intra-Community supplies made by a taxable person to acquirers identified for VAT purposes in other Member States.

At present, the CJEU considers that Member States can not refuse to grant the benefit of the VAT exemption applicable to intra-Community supplies on the sole ground that the supplier did include the supply in its Recapitulative Statement.

As of 1 January 2020, the new measure provides that including the supply in the Recapitulative Statement is a substantive condition for the supplier to benefit from the VAT exemption applicable to intra-Community supplies.

Failing to submit the Recapitulative Statement can lead to the taxation of intra-Community supplies.

However, the VAT Directive also provides that if the supply is included in the next period, then the VAT exemption remains applicable.

Thus, special attention should be paid to Recapitulative Statements submitted by companies (or on their behalf) in order to secure their intra-Community transactions.

Example:

- Supplier A established in the Netherlands supplies goods to an acquirer B established in Germany;

- The goods are dispatched by the supplier from the Netherlands to Germany;

- The goods are dispatched on January 10th.

Supplier A has to include the intra-Community supply in its Recapitulative Statement in the Netherlands no later than the 10th working day of February 2020.

Failing to include the intra-Community supply in the Recapitulative Statement no later than the 10th working day of February 2020 (or at least no later than the 10th working day of March 2020) could lead to the taxation of the supply in the Netherlands.

Harmonized but stricter rules to prove the intra-Community transport of goods

In order to benefit from the VAT exemption applicable to intra-Community supplies, the supplier must prove that the goods were transported from one EU Member State to another EU Member State.

At present, the VAT Directive does not specify how this proof has to be provided. There is therefore great differences between Member States and too much flexibility for tax administrations to determine whether the transport is proved or not.

As of 1 January 2020, the Directive specifies the rules for proving the intra-Community transport of goods.

Where the intra-Community transport is arranged by the supplier, the supplier has to provide 2 proofs :

- either 2 non-contradictory proofs of transport provided by two independent persons: CMR, bill of lading, air cargo invoice, or carrier invoice;

- or 1 proof of transport + 1 other non-contradictory evidence such as an insurance contract relating to the international carriage of goods or an acknowledgment of receipt of the goods by the storage provider in the Member State of

Where the intra-Community transport is arranged by the acquirer, the supplier has to provide 3 proofs :

- the same 2 proofs as where the transport is arranged by the supplier (see above);

- + 1 acknowledgment of receipt of the goods by the acquirer in the Member State of arrival

Example

- Supplier A established in France supplies goods to an acquirer B established in Germany ;

- The goods are dispatched from France directly to the acquirer’s premises in

If the transport is arranged by supplier A , supplier A has to provide :

- either 1 CMR + 1 carrier invoice ;

- or 1 CMR ou 1 carrier invoice + 1 insurance contract relating to the

If the transport is arranged by acquirer B , supplier A has to provide :

- either 1 CMR + 1 carrier invoice + 1 + 1 acknowledgment of receipt of the goods in Germany ;

- or 1 CMR ou 1 carrier invoice + 1 insurance contract relating to the transport + 1 acknowledgment of receipt of the goods in

In the event that supplier A is unable to provide all of this evidence, or if it is not valid (because not readable, incomplete, unsigned …), French VAT could be applied to the supply.