Taxation remains a complex subject within the European Union. According to a study by the European Commission, The European Union member countries lost 151,5 billion euros in 2015, from which one third or 50 billion due to the VAT fraud.

Indeed, since the lifting of fiscal borders among the EU member countries, VAT fraud has seen an evolution. In its most complicated form – the carousel fraud – it presents several dangers not only for the countries that lose their income, but also for the companies that may become part of the fraud chain without even knowing it.

INTRA-COMMUNITY VAT : THE PRINCIPLE

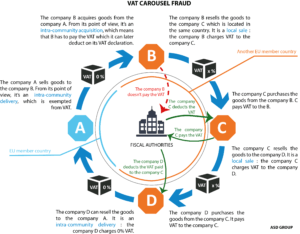

Today, B2B intra-community deliveries in the EU are exempted from VAT. It is the company that acquires a merchandise from another company in another EU member country that has to declare and pay VAT in its country, meaning in the destination country of the merchandise. Nevertheless, when filling out the VAT declaration, the company can deduct the corresponding VAT amount, which means that in the reality VAT becomes neutral.

VAT FRAUD EXPLAINED

Often, two types of VAT fraud are distinguished : the simple VAT fraud and the VAT carousel fraud. We talk about the simple VAT fraud in a case when a company purchases goods from another company in another EU member country, and afterwards resells them on the domestic market for very competitive prices, due to the exemption from VAT. Afterwards, the company disappears before reversing VAT on the sales price to the state. When this type of fraud is repeated in a circular way, we can talk about the carousel fraud. It consists of creating several companies in at least two different EU member countries which then carry out fictive operations between themselves. They always ask for a VAT reimbursement, but never reverses VAT to the fiscal authorities.

DANGERS FOR THE COMPANIES

It is not only the companies initiating the fraud that risk heavy sanctions. Indeed, each link of the VAT fraud chain, unless it’s been impossible for the company to be aware of its participation in this fraud, risks to lose its right of VAT exemption for intra-community deliveries, to be denied his right to VAT deduction or to undergo a solidarity payment procedure.

ATTENTION TO THE SIGNS INDICATING A RISKY SUPPLIER

Several signs can indicate a shady supplier, for example, its intra-community VAT number might be invalid. You should also pay attention to a transaction price that is much lower than the market price, insistance for a payment in cash and other factors that might indicate a fraudulent transaction.

BEING IN COMPLIANCE WITH THE REGULATION

Nevertheless, to avoid the sanctions your first and foremost action should be to make sure that your company is in a perfect compliance with the regulation in force. The administrative formalities are complex, in case of doubt about how to fill out your VAT declarations, get in touch with our VAT experts.