The Finance Act for 2025 confirms the end of one-off fiscal representation for imports under the customs regime 42, used in particular by non-European companies, including British ones. This abolition will take effect on 31 December 2025, giving the affected businesses a few months to adapt.

End of one-off fiscal representation: what does the law say?

The Finance Act for 2025 has repealed the one-off fiscal representation regime provided for in Article 289 A III of the General Tax Code (CGI).

In practice, registered customs representatives are no longer permitted to use their own VAT number to act as a one-off fiscal representative for imports under customs regime 42 on behalf of companies not established in the European Union.

This abolition therefore requires non-European businesses to:

- register for VAT in France;

- file their own VAT returns.

The new fiscal agent regime introduced in Article 289 A bis of the CGI does not cover imports under regime 42 and therefore does not constitute an alternative for these operations.

Direct consequences for non-European businesses

- They will now have to obtain an individual VAT number in France and file their own VAT returns.

- The new fiscal agent regime (Article 289A bis) does not cover imports made under regime 42.

British companies and other businesses not established in the European Union must therefore anticipate this obligation and register for VAT in France before 31 December 2025 to continue importing using the Incoterm DDP.

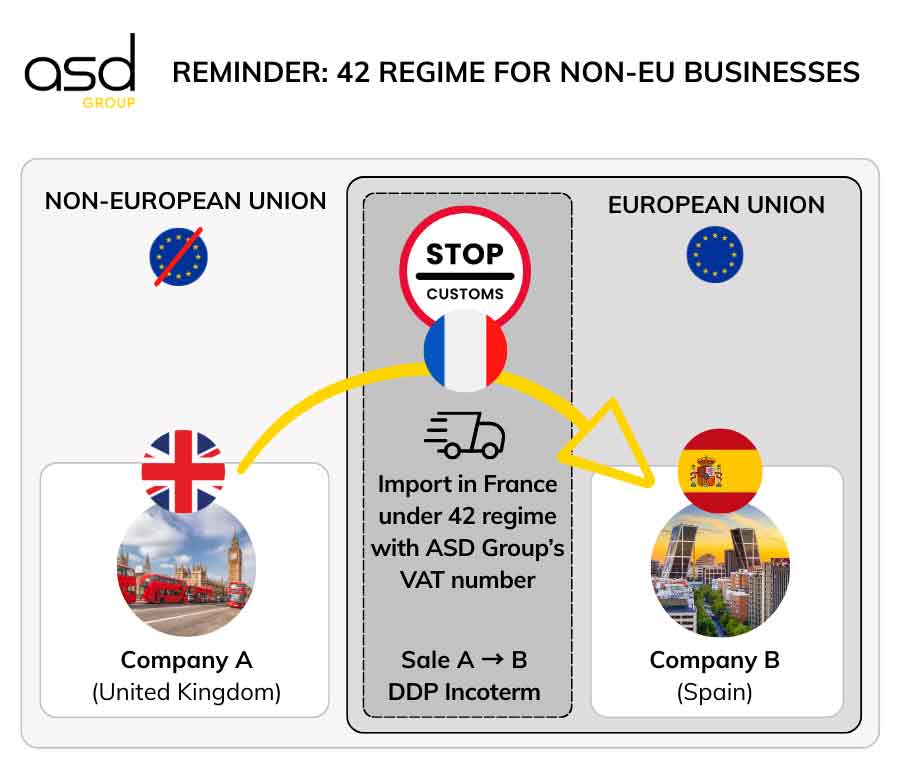

Reminder: how did regime 42 work with one-off fiscal representation?

Let’s take a concrete example:

A British company sells goods to a Spanish company under Incoterm DDP. The goods are cleared through customs in France, with the British company as the official importer. They are then immediately shipped to the taxable Spanish client.

Conditions for benefiting from VAT exemption on imports

For imports into France to be exempt from VAT, several conditions must be met:

- The goods shipped to another Member State (e.g., Spain) must be those imported into France under regime 42.

- The official importer in France must be the one making the sale (e.g., the British company).

- The intra-Community shipment must be immediately subsequent to the import (48 hours maximum in practice).

- The importer must provide customs with proof of intra-Community transport (e.g., to Spain).

Role of the one-off fiscal representative

Until 31 December 2025, a British company may appoint a one-off fiscal representative such as ASD Group, which uses its own VAT number in the customs declaration.

This representative also handled all tax reporting obligations:

- VAT

- EU sales list

- Intrastat

This mechanism allows non-European companies to avoid VAT registration in France and reduce their administrative costs.

Why is regime 42 losing its appeal after 2025?

Since 1 January 2022, the mechanism of self-assessment of import VAT has become widespread. It allows companies to import into France under regime 40 (release for consumption) in a fiscally neutral manner: VAT is simultaneously collected and deducted on the French VAT return.

Limitations of regime 42 after the reform

Until now, regime 42 allowed companies not established in France – particularly British ones – to avoid VAT registration in France. But from 1 January 2026:

- VAT registration in France will be mandatory to import under regime 42.

- Regime 40 already offers a simplified and neutral mechanism through self-assessment of VAT, without cash flow advances or customs payments.

How British businesses can prepare

- Obtain a French VAT number:

From 1 January 2026, businesses will need to register to obtain a French VAT number to import under regime 4000. - Adapt import processes:

Businesses must review and adjust their logistics processes to comply with the new import requirements, including the transition to intra-Community delivery. - Train staff:

It is essential to train teams on the new tax and customs regulations to ensure a good understanding of the changes and maintain compliance. - Consult experts:

Engaging tax or customs advisors can help navigate the new rules and avoid costly mistakes. - Update accounting systems:

Accounting systems must be updated to incorporate the new VAT requirements and facilitate the handling of intra-Community transactions. - Inform clients and partners:

Communicating with clients and partners about upcoming changes can help manage expectations and ensure a smooth transition. - Assess costs:

Businesses must analyse the financial impact of the new regulations and adapt their business strategy accordingly.

By implementing these measures, British businesses will be better able to adapt to the end of regime 4200 and continue their operations without interruption.

Anticipate your VAT registration with ASD Group

To continue importing into France from 1 January 2026, non-European businesses must mandatorily be registered for VAT in France.

ASD Group can assist you with your VAT registration to secure your import-export operations within the European Union.

Don’t wait! Contact our experts now before it’s too late to comply!