Nowadays, many companies are facing the problem of recovery of foreign VAT because it is strictly controlled and the existing procedures are often long and complicated, sometimes involving very large sums of money.

In this article, we will give you the top tips which will help make these processes a little more transparent and show you how the ASD group can make your life simpler. Let us consider more closely the specific characteristics of this VAT refund request process and its complexity.

WHAT CONDITIONS MUST BE FULFILLED TO RECOVER FOREIGN VAT?

Refunding of intracommunity VAT relates to companies subject to VAT in one of the European Union countries.

The company must have had a transaction with a trading partner in another European country and have respected the VAT regulations of the country concerned.

Refund conditions are as follows:

- Your company must be subject to VAT in your country.

- You cannot be a registered taxpayer in the country in which you submit a request for a VAT refund.

- You may not have engaged in taxable supplies of goods or services in the country.

It is important to note that not all expenses are refundable. The following are examples of eligible expenses:

Expenses must be essential to the performance of the economic activity, for example: expenses related to transport and meals, entry fees to fairs and exhibitions, etc.

Caution: nevertheless, because possible deductions may differ from country to country, you will need to ensure that your expenses are actually deductible in the country of your trading partner.

WHAT SUPPORTING DOCUMENTS ARE REQUIRED TO RECOVER FOREIGN VAT?

As proof of an expense, you will be asked to present your invoices including certain mandatory information, in particular your intracommunity VAT number and that of your supplier. Invoicing rules vary from country to country (i.e. information to be provided on the invoice). It is important to check whether your invoice is fully compliant with local rules in order to be able to submit the request.

Depending on the amounts to be recovered, the authorities can also request proof of bank transfers, cheques and bank card receipts, because in the absence of supporting documents, the authorities can block and/or refuse the request.

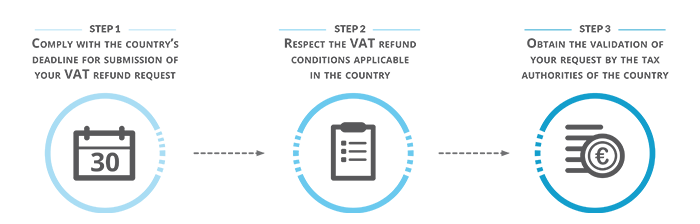

WHEN AND HOW TO MAKE THE VAT REFUND REQUEST

It is important to note that the VAT refund is possible only after you have submitted your request electronically via the portal made available to you by the EU country in which your head office is domiciled.

The deadline for making the request, for companies established in the European Union, is 30thSeptember of the following year. For example, you have until 30th September 2017 to submit a VAT refund request for foreign VAT paid in 2016.

The minimum refund amounts differ from country to country, as does the frequency of submission of requests. You can submit requests either quarterly or annually. In France, for example, refund requests are not admissible unless they relate to a minimum amount, of 400 euros for quarterly requests and 50 euros for annual requests.

We provide specific tools on this topic to guide you as effectively as possible and simplify for you each process involved in the intracommunity VAT refund. For further information on our service, consult our dedicated page or contact us via our contact form. We will assist you from start to finish in recovering your foreign VAT in the 28 member States of the European Union.