The reverse charge of import VAT is a tax regime introduced by the European Union to facilitate trade in international commerce.

It allows businesses not to pay VAT on imported goods, but to declare and pay it directly to the tax authorities. In this article, we will look in more detail at how the reverse charge of import VAT works and the advantages it offers businesses.

What is the reverse charge of import VAT Import?

The reverse charge of VAT Import (or ATVAI in France for “Autoliquidation de la TVA Import”) is a tax regime that allows businesses and importers not to pay VAT on the importation of goods from third countries. Indeed, the VAT is paid directly to the tax authorities by the company importing the goods. The ATVAI only applies to businesses that are liable for VAT and import goods from third countries (outside the EU Member States). This mainly concerns businesses that import goods for resale or consumption, such as foodstuffs, but not businesses that import goods for their own use.

How the reverse charge of import VAT works?

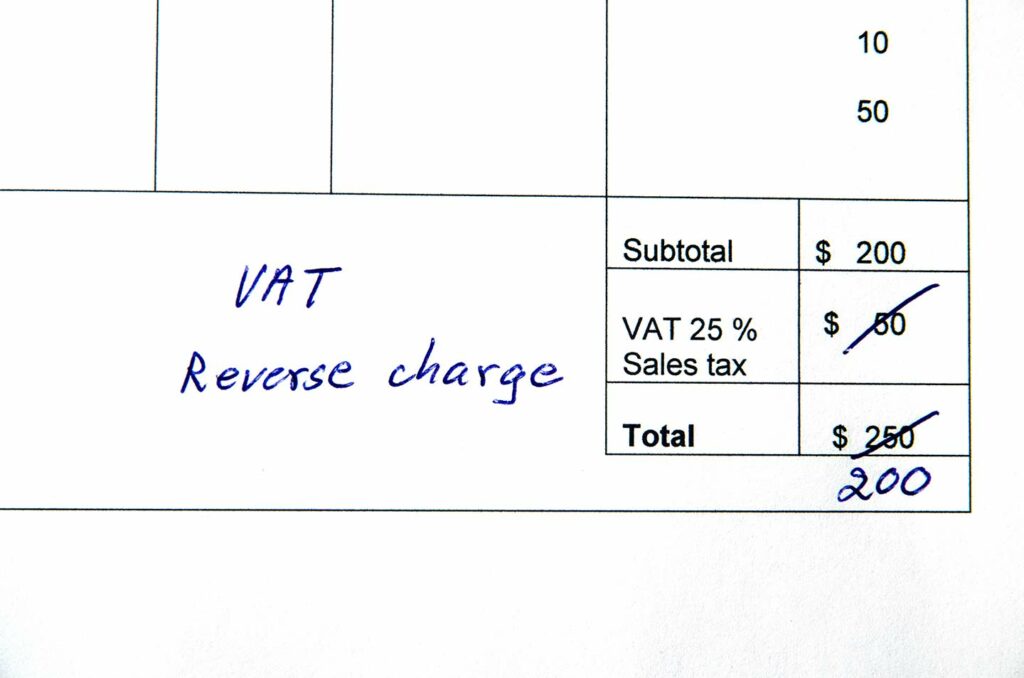

When a taxable business imports goods from a third country, it must declare the VAT due to the tax authorities directly in the VAT return. The business or importer must then collect the VAT due directly from the tax authorities on the basis of this import and immediately deduct it on the same return (reverse charge principle).

Read more on the same topic

How does the reverse charge of import VAT work?

Reverse charge of import VAT: benefits for companies

The reverse charge of VAT on imports offers many advantages to businesses importing goods from third countries:

- Firstly, it allows businesses to avoid paying VAT at the time of import, which can represent a significant cash flow saving. Indeed, businesses can avoid raising funds to pay import VAT, which can allow them to invest these funds in their business.

- In addition, the reverse charge of VAT on imports allows businesses to simplify their administrative procedures. They can declare and pay VAT directly to the tax authorities, making it easier to monitor their tax situation.

- Finally, the reverse charge of Import VAT allows companies to reduce the risk of disputes with foreign suppliers. Indeed, by paying VAT directly to the tax authorities, they can avoid conflicts related to VAT, payment methods and supporting documents related to the deductibility of this VAT.

Read more on the same topic

France : Nouveau service en ligne « Données ATVAI » pour les déclarations douanières

The conditions of application of the reverse charge of VAT on imports

In order to benefit from the reverse charge of VAT on imports, companies must respect certain conditions which depend on the country which has applied it. In France, the import VAT reverse charge is automatic and mandatory when :

- Firstly, they must be subject to VAT and be able to declare and pay VAT to the tax authorities (filing periodic returns);

- Secondly, they have to import goods into Europe and goods from third countries, i.e. outside the EU;

- Finally, the imported goods must be released for consumption in France and imported in the course of the taxpayer’s economic activity.

It is important to note that the reverse charge of VAT on imports does not apply to goods imported from another EU country, as these imported goods are subject to the intra-Community value added tax regime. In addition, it is important to comply with the rules on customs formalities and VAT to avoid any risk of penalties or disputes with the tax or customs authorities.

Customs formalities to be respected to benefit from the reverse charge of VAT due on Importations

In addition to the conditions for benefiting from the reverse charge of VAT on imports, importers must also comply with the relevant customs procedures. Indeed, importing goods from third countries implies customs declaration obligations, in particular the declaration to customs and the payment of customs duties and taxes as well as import taxes.

It is therefore important to be well informed about the formalities of customs clearance operations to be respected according to the type of goods imported and the country of origin. Companies can be accompanied by a freight forwarder or a customs agent specialising in customs processes to facilitate administrative procedures and avoid errors that could lead to financial penalties.

Furthermore, the reverse charge of VAT on imports does not exempt companies from the obligation to keep accounts in accordance with the rules in force and to retain the supporting documents relating to the import of goods. These records must be kept for at least 10 years from the date of the transaction.

Finally, companies must also be vigilant in complying with the rules on value added tax, particularly with regard to the application of VAT rates depending on the goods imported and their destination.

By complying with these customs and tax formalities, businesses can take full advantage of the reverse charge of Import VAT and reduce the risk of disputes with the customs service.

In conclusion, the reverse charge of VAT on imports is an advantageous tax regime for companies importing goods from third countries. It simplifies administrative procedures and reduces the risk of disputes with foreign suppliers. However, it is important to respect the conditions of application and the rules relating to customs procedures and the customs and VAT regulations set up by the French Customs in order to benefit from this tax regime in an optimal way.

Contact ASD Group and work with a specialised team that will support you on a daily basis and help you secure your VAT.