New - ASD Taxflow: Optimise your VAT returns Learn more

Customs: Abolition of the 4200 regime: what changes from 1 January 2026 More info

Due diligence statement: What does the EUDR say against deforestation? More info

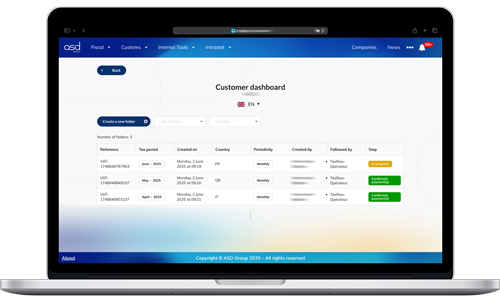

CENTRALISE, SECURE, AND MANAGE ALL YOUR VAT DECLARATION OBLIGATIONS WITH A COMPREHENSIVE SOLUTION DESIGNED FOR DEMANDING BUSINESSES.

Optimise your time and simplify the sharing and management of your files with just a few clicks. ASD Taxflow is an exchange platform with our operators that is quick to use.

Using our platform thus reduces the costs associated with printing, postal or email sending, and paper management.

All files and declaration documents are consolidated in a single interface.

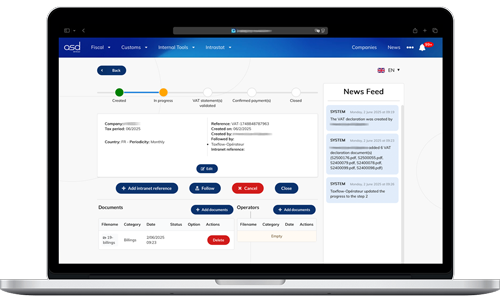

Optimisation of all your electronic exchanges with our operators and real-time assistance.

You ensure that your declarations are compliant.

Anticipate VAT declarations and present them during audits.

Reduce your carbon footprint with ASD Taxflow: a 1 MB email emits 11 g of CO₂, up to 50 g with multiple attachments, while 1 GB stored for a year in France emits 0.24 g.

Demonstrate your compliance with administrative requirements

Managing VAT declarations in multiple European Union countries is a real headache for many businesses. Between local regulations, invoicing obligations, deadlines to meet, and declaration formats specific to each Member State, the risk of error or delay is significant — and can lead to substantial financial penalties.

Our software solution is designed to simplify and secure this management. It enables you to centralise all your periodic VAT declarations, payment tracking, and the history of exchanges with our operators handling your declarations in a single interface.

No more scattered spreadsheets, follow-up emails, and multiple platforms: everything is consolidated, structured, and accessible in real time.

You can upload all documents related to each of your VAT files (such as invoices, credit notes, etc.) and retrieve them at any time. A significant time saving during audits.

In the event of a tax audit in a Member State, the administration may require quick access to the relevant invoices.

ASD Taxflow enables you to quickly export invoices and associated documents, formatted to meet local requirements.

ASD Taxflow is a platform for exchanging your VAT declarations. All this to provide you with a global overview, allowing you to focus on the essentials.