The European customs landscape is undergoing profound change. Importing goods from a third country into the European Union, already subject to numerous formalities, is being transformed by the introduction of a new dematerialised system, particularly in France: DELTA IE. This major change is accompanied by the gradual disappearance of a document that has been in use for over thirty years: the SAD (Single Administrative Document).

In its place, a new declarative approach is being introduced: the new H1 import system (which takes the form of an electronic dataset and a fully dematerialised data system), now essential for importing goods into the European Union.

This comprehensive guide will help you understand:

- what DELTA IE is in France,

- what changes with the H1 system,

- why the SAD is disappearing,

- how the new import procedure works in practice,

- practical examples for importers and logistics providers.

ASD Group Customs has been supporting European companies with their customs formalities for over 20 years.

Each year, our teams process several thousand declarations (import/export) and closely monitor technical developments such as DELTA IE, ATLAS (Germany), CDS (United Kingdom) and AIDA (Italy).

Thanks to our role as an official partner of international operators, we directly observe the difficulties encountered during the switch from SAD → H1 and the impacts on the supply chain.

What is DELTA IE and what is it for?

DELTA IE (I for Import, E for Export) is a new online customs clearance service developed by French Customs. The Union Customs Code (UCC), which entered into force in 2016, requires the establishment of interoperable national information systems.

This development involves a complete overhaul of existing customs systems to enable their use within the framework of European Centralised Clearance (ECC). DELTA IE is the French system.

It enables the receipt and processing of customs declarations in a fully dematerialised manner and is intended to replace the current DELTA-G and DELTA-X systems.

What are the objectives of DELTA IE?

DELTA IE forms part of a European modernisation of customs processes. Its objectives are:

- fully digitalise customs clearance (end of paper),

- streamline the supply chain by allowing advance declarations,

- standardise customs data at European level,

- enable automation via API/EDI for companies with regular flows.

This is not merely an update to DELTA-G: it is a complete overhaul of the customs model.

DELTA IE Roll-out Schedule – Import and Export Phases

The DGDDI is rolling out the DELTA IE system progressively in order to modernise and simplify customs declarations in France. It is essential for importers, exporters and freight forwarders to be aware of the key dates so that they can prepare their systems, train their teams and inform their clients.

| Phase | Event | Date |

|---|---|---|

| Import | Bug fixes and adjustments (version 1.x) | 15 April 2025 |

| Import | End of migration of import flows | 30 September 2025 |

| Import | Closure of submissions in DELTA G (import) | 22 October 2025 |

| Export / SDS | Official go-live | 4 November 2025 |

| Export / SDS | End of transition period (export) | 14 December 2025 |

National electronic customs clearance systems in the European Union

Each EU Member State has its own national electronic customs clearance system, equivalent to the French DELTA IE system.

| Country | National System / Description |

|---|---|

| Germany | ATLAS / ZMWS (e-Customs/ATLAS) |

| Austria | e-Customs (Import/Export e-Zoll) |

| Belgium | AES / iDMS / eDMS (new national platform for declarations; replaces PLDA) |

| Bulgaria | National e-Customs System / Electronic Customs System (BNCA e-customs) (generic name: e-Customs) |

| Cyprus | National Customs e-declaration portal (e-Customs / NIS) |

| Croatia | e-Carina (e-Customs) |

| Denmark | Customs declaration system (Toldsystem / e-Customs portal) |

| Spain | Electronic SAD via Agencia Tributaria (AEAT) — electronic customs declaration portal (SAD / e-ADUANA) |

| Estonia | e-MTA / e-tax & customs (e-Customs) |

| Finland | Tulli e-services / e-Customs (Customs Declaration System) |

| France | DELTA IE (French national goods entry system) |

| Greece | ICISnet / e-Customs (customs portal) |

| Hungary | Customs administration system / e-Customs (national declaration system) |

| Ireland | Automated Import System (AIS) / AIS (Import system) |

| Italy | AIDA / A.E.D. (Agenzia delle Dogane e dei Monopoli portal — e-customs services) |

| Latvia | eCustoms / NIS (national import system) |

| Lithuania | MDAS — Customs Declaration Processing System (MDAS) |

| Luxembourg | NIS (National Import System) / LUCCS (portal) |

| Malta | National Import System (NIS) / Maltese Customs e-portal |

| Netherlands | AGS / e-Customs (Dutch Customs e-portal / AGS system evolutions) |

| Poland | SAD / ICS / e-Customs portal (National Customs System / electronic customs declarations) |

| Portugal | AT (Tax and Customs Authority) – e-customs portal / Electronic declaration system |

| Czech Republic | eCustoms / ISK (national electronic exchange system; exact name varies by module) |

| Romania | Customs Electronic Declaration System (Vamal electronic system / e-Customs) |

| Slovakia | eCustoms / NCTS / national declaration portal (local name varies) |

| Slovenia | SIAIS / e-Customs (Slovenian Automated Import System) |

| Sweden | Tullverkets e-services / e-Customs (Swedish customs e-declaration portal) |

Why is the SAD Single Administrative Document disappearing as part of customs modernisation?

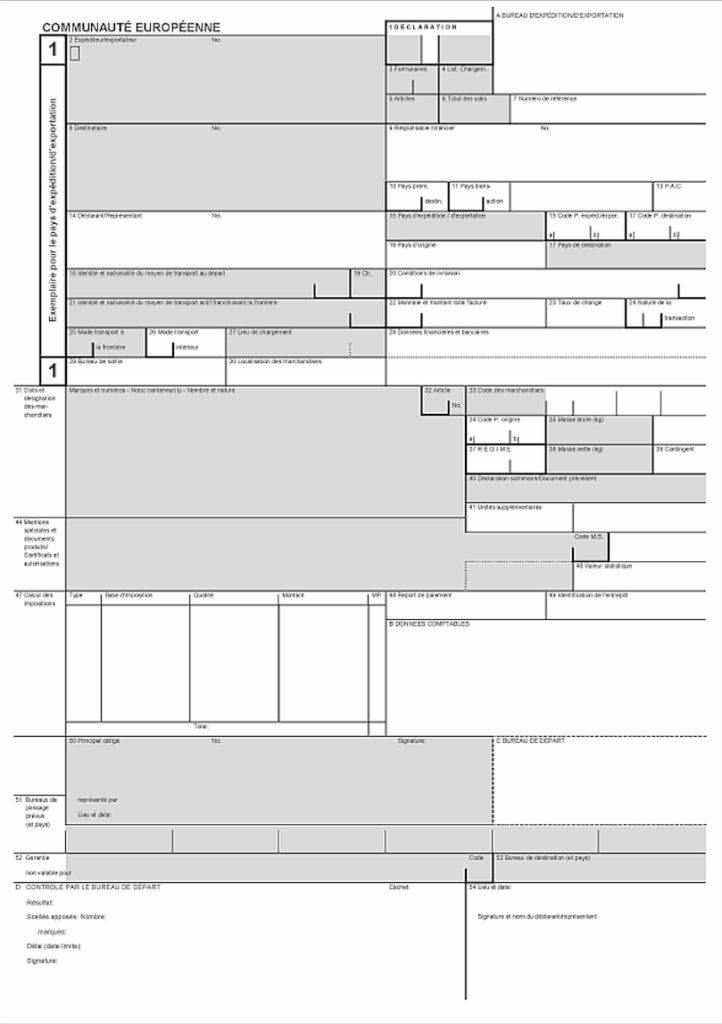

The SAD Single Administrative Document has until now been the standard form for all customs declarations (imports, exports and transit).

For decades, it was submitted in paper form or as a PDF using clearance software.

The SAD Single Administrative Document is being phased out as part of European customs modernisation due to the introduction of an automated IT system known as “ICS / CDS / DELTA” depending on the country, which is gradually replacing paper-based processes with electronic customs declaration management.

- Shift to electronic processes: the paper SAD is being replaced by IT systems such as DELTA, ATLAS or CDS, depending on the country.

- Time and cost savings: no more need to print, send or physically archive the SAD.

- Direct connection to tax and customs authorities: all information is transmitted automatically, speeding up clearance.

- European interoperability: electronic systems enable harmonised information exchange between all Member States.

What replaces the SAD in the new customs clearance model?

The SAD is disappearing because all declarations are now made electronically through centralised customs systems. This digitalisation simplifies and harmonises procedures while reducing errors. Companies nevertheless remain responsible for the information submitted.

| Limitations of the SAD (former system) | Advantages of the new system |

|---|---|

| Declaration on arrival of the goods | Pre-arrival declaration |

| Document/form to complete | Exchange of structured electronic messages |

| Process not very compatible with automation | API / EDI compatible in DELTA IE |

| Late risk analysis | Risk analysis before unloading |

With DELTA IE, you no longer complete an SAD form; instead, an H1 message is transmitted. The import SAD is replaced by the H1 declaration in DELTA IE.

What is the H1 procedure and why is it becoming the new standard?

The H1 declaration is the electronic message used to declare the importation of goods in DELTA IE.

It fully replaces:

- the import SAD,

- paper forms,

- the former DELTA-G import procedures.

What are the objectives of the H1 declaration?

- Declare goods before their arrival in French territory,

- Enable faster customs controls,

- Secure the supply chain,

- Reduce immobilisation times.

How does the system overhaul mark the end of the SAD?

This overhaul also marks the disappearance of the “sacrosanct” Single Administrative Document (SAD), well known to businesses for several decades.

This historic form is now giving way to a fully dematerialised customs declaration in the form of a structured electronic message:

- H1 for imports,

- B1 for exports.

Unlike the SAD, which consisted of 56 boxes to complete, these new electronic declarations comprise approximately 120 data elements grouped by theme (goods, transport, taxation, supporting documents, etc.).

Each piece of information is transmitted as digital data and processed automatically by DELTA IE.

The SAD is gradually disappearing in favour of a structured, digital and automatable model.

What does an H1 electronic message contain?

The H1 electronic message is the structured format used to declare goods for import via DELTA IE. It is designed to replace the SAD Single Administrative Document and contains approximately 120 data elements grouped by theme.

| Category | Main data | Description |

|---|---|---|

| Sender and consignee | Name, address, EORI number, intra-Community VAT number | Identifies the economic operator responsible and the consignee of the goods |

| Description of goods | HS code, detailed description, quantity, weight, volume, value, country of origin, batch/serial number | Replaces the SAD boxes relating to the nature and value of the goods |

| Transport | Mode of transport, transport document number (bill of lading, waybill), port/airport/border of entry, expected date/time of arrival, Incoterms | Enables customs to plan controls and facilitate the release of goods |

| Supporting documents | Commercial invoice, certificate of origin, specific licences or authorisations, declarations of conformity | Provides the supporting evidence required for compliance and regulation of the goods |

| Tax data and customs procedures | Customs procedure code (import, transit, warehousing, inward processing, etc.), VAT, applicable duties, payment method | Enables calculation and declaration of duties and taxes |

| Security and additional information | Gross/net weight, package or container dimensions, carrier information, internal references / tracking number | Ensures traceability and security of the goods |

The system then assigns an MRN (Movement Reference Number), which is essential for the release of the goods.

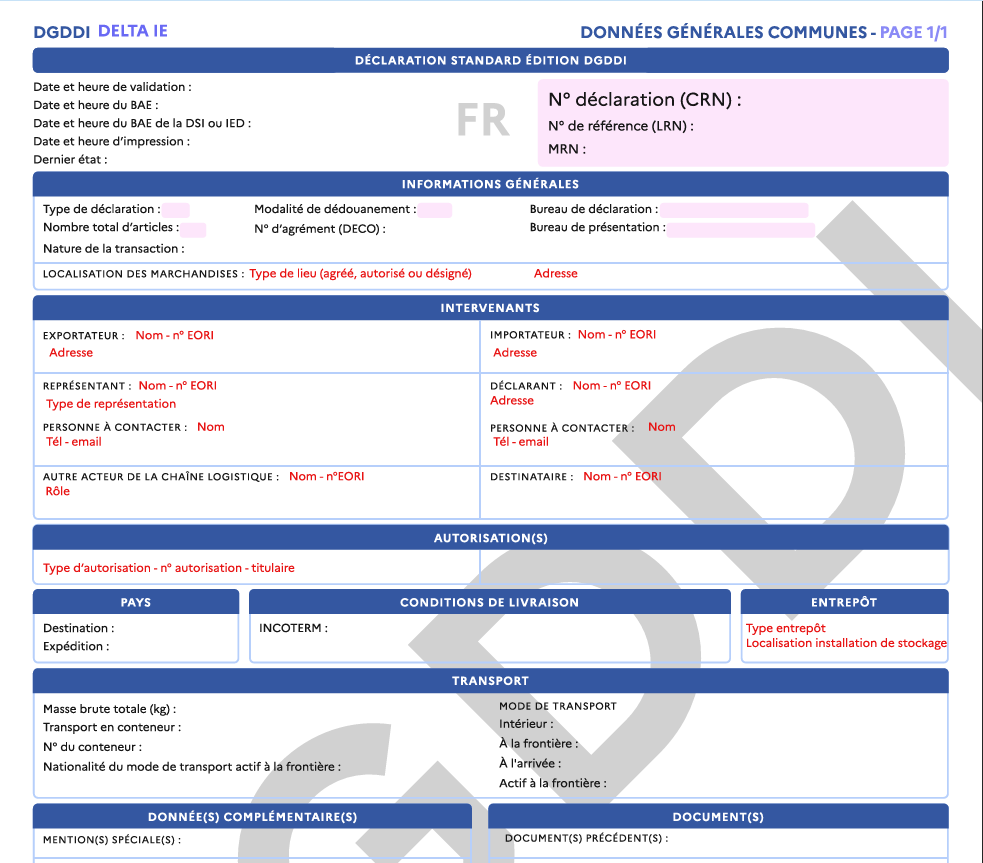

What does an H1 look like?

Here is what an H1 declaration looks like in the DELTA IE system: a structured form containing the essential customs data (EORI, transport, items, etc.).

You can view the official PDF template published by the DGDDI here for reference, particularly if you need to create your own editing interface.

How does the import process work with DELTA IE and H1?

Here is the complete process, from submission of the declaration to the release of the goods.

Step 1: Data preparation

The company imports goods and gathers the required documents:

- commercial invoice,

- bill of lading (BL) / transport document,

- certificates of origin or other certificates.

Step 2: Lodgement of the H1 declaration via DELTA IE

Two methods depending on the volume of activity:

| Solution | Targeted at |

|---|---|

| DELTA IE portal (manual entry) | Occasional importers or low-volume operators |

| API / EDI interface | Companies with high import volumes, integrated into ERP or TMS |

Step 3: Risk analysis

Customs examines the declaration before the arrival of the goods.

Possible outcomes:

- Green channel: goods released immediately,

- Orange channel: request for additional documents,

- Red channel: physical inspection.

Step 4: Allocation of the MRN

Once validated, the H1 declaration is assigned an MRN, a unique identification number.

Step 5: Release of the goods

The carrier presents the MRN to the customs authorities → the goods are released to the consignee.

What are the differences between the SAD Single Administrative Document (DAU) and the H1 declaration?

DELTA IE with H1 helps reduce storage costs and logistical delays.

| Criteria | Former system (SAD Single Administrative Document) | New system (H1 via DELTA IE) |

|---|---|---|

| Declaration type | SAD Single Administrative Document form | Electronic H1 message |

| Pre-arrival declaration | ❌ no | ✅ yes |

| Automation / API | ❌ limited | ✅ full (EDI / API) |

| Risk analysis | After arrival | Before arrival |

| Logistical speed | Average | Optimised |

| Objective | Declare | Anticipate + secure |

How does the electronic H1 system work in practice?

Case 1: Import of textiles from Bangladesh

- H1 message sent 48 hours before arrival at Le Havre

- Risk analysis carried out in advance

- MRN received before the container is unloaded

Result:

No hold-ups – container released immediately upon arrival.

Case 2: Import of electronic components from China

- EDI integration between the company’s ERP and DELTA IE,

- Automatic submission of dozens of H1 declarations per day,

- Complete elimination of manual SAD Single Administrative Document tasks.

Result:

Full automation and faster customs clearance.

Case 3: Automotive supply chain (just-in-time)

- Daily imports of parts,

- H1 declarations submitted before the ship/aircraft departs,

- Declarations validated before arrival.

Result:

Secure production with zero stock shortages.

What are the practical implications for importers using DELTA IE and H1?

| Area | Impact of the transition from SAD to H1 |

|---|---|

| Document management | No more SAD Single Administrative Document forms |

| Logistics organisation | Declarations must be lodged in advance |

| IT systems | Possible API/EDI integration |

| Customs controls | Carried out earlier, fewer hold-ups |

| Costs | Reduction in storage and demurrage costs |

For companies submitting hundreds of declarations each month, the time savings are considerable.

ASD Group: Your partner with full mastery of DELTA IE and the H1 system

The introduction of DELTA IE and H1/B1 declarations marks a major transformation in French customs clearance. The disappearance of the SAD Single Administrative Document and the shift to structured electronic messages enable companies to gain greater foresight, speed and reliability while reducing the risk of errors and hold-ups on imports and exports.

In this context, ASD Group Customs supports companies with:

- the preparation and submission of H1 and B1 declarations,

- the complete management of your import and export customs formalities,

- MRN tracking and customs control monitoring to ensure the secure release of your goods.

Thanks to its expertise, ASD Group Customs enables companies to reduce customs clearance times, optimise their supply chain and remain compliant with the new French and European customs obligations.

By choosing ASD Group, importers and exporters benefit from comprehensive, digital and secure support to navigate the new customs landscape with confidence.

Contact us!

Would you like to learn more about our services and discover how we can simplify your customs procedures and manage your H1 declarations?

Sandrine Berdougo

Customs & Intrastat Manager

Since 2017, Sandrine Berdougo has held the position of Customs & Intrastat Service Manager at ASD Group, where she heads up the customs unit and oversees all services related to VAT and Intrastat/EMEBI declarations. With over eight years of experience in Sophia Antipolis, she conducts audits, studies and process optimisations to improve the performance and profitability of customs services. She also monitors the flow of goods for French, European and international clients, while maintaining constant contact with the tax authorities and the group’s European subsidiaries.

Official sources and references (in French):