Looking to understand the Incoterms rules? Find out how they define the transfer of risks and responsibilities between buyer and seller in international trade transactions.

Today, with the influx of goods and the specifics of international trade, it is important to understand the role of Incoterms in trade. Whether you are a buyer, a seller or a carrier, Incoterms 2020 came into force in January 2020 and subjects every trade transaction to a series of rules and standards that govern the transfer of risks and costs between the two parties. In this article, we find out in more detail what the updated Incoterms mean.

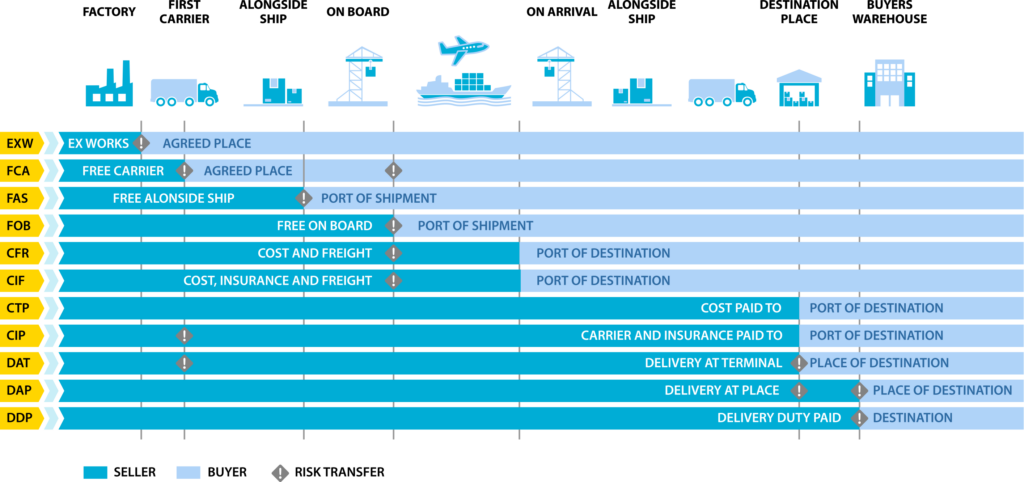

Incoterms, a contraction of the English term “International Commercial Terms”, are international trade terms used to organise transport. These rules define the responsibilities and obligations of the seller and buyer parties, as well as the transfer of risks and costs between them. Incoterms can also be used to determine the primary mode of transport, place of delivery, port of destination and customs clearance procedures.

What are Incoterms?

Incoterms 2020 (content in French) are updated international trade rules, put in place to simplify the understanding between sellers and buyers regarding the transfer of risks and costs associated with the carriage of goods in an international sales contract. These rules are linked to the value for duty, allowing the parties involved to clearly understand what their obligations will be under the chosen Incoterm.

Read more on the same subject

What are Incoterms?

Incoterms types and classification

There are 11 Incoterms in 4 categories:

- Category E (departure),

- Category F (main carriage unpaid),

- Category C (main carriage paid),

- Category D (arrival).

What’s new in Incoterms

Incoterms 2020 has made some notable changes to its previous versions. There are several new provisions relating to the correct use of Incoterms, such as :

- EXW (Ex Works): The selling party assumes minimal responsibility – it only has to deliver the goods to the agreed point in accordance with the contractual specifications;

- FCA (Free Carrier): The seller bears all costs until the goods are handed over to the carrier chosen by the buyer;

- CPT (Carriage Paid To): In this Incoterm, the seller bears all costs up to the agreed place where the goods will be delivered;

- CIP (Carriage and Insurance Paid To): Here, the seller not only pays the transport costs to the agreed location where the goods are delivered, but also insures the goods during transport.

How do Incoterms affect international trade?

Incoterms are essential for organising efficient international trade. They clearly define the responsibilities of buyers and sellers, as well as the transfer of risks and costs between them. Incoterms can also be used to determine the primary mode of transport, place of delivery, port of destination and customs clearance procedures.

Responsibilities of sellers and buyers

Depending on the Incoterm chosen, the responsibilities of the seller or the buyer will be different. For example, if you choose FCA (Free Carrier), this means that the seller is responsible for arranging transport to the point agreed in the sales contract and will pay all associated costs. On the other hand, if you choose CIP (Carriage and Insurance Paid To), it means that the seller assumes all responsibilities until the goods are handed over to the buyer at the agreed port.

Transfer of risks and costs

Another important consideration is the transfer of risk and costs between the seller and the buyer. If you choose EXW (Ex Works), for example, then this indicates that the seller will not be responsible for any damage to the goods after they leave the shipping point. On the other hand, if you choose DAP (Delivered At Place), then this means that the selling party will assume all risks associated with the transport until the goods arrive at their destination.

Main mode of transport

The primary mode of transport varies according to the Incoterm chosen. For example, if you choose FOB (Free On Board), then this usually involves a ship as the primary means of transporting your goods. Whereas if you choose CPT (Carriage Paid To), then it will be a truck or car.

Place of delivery

Like the primary mode of transport, the place of delivery will also depend on the type of incoterm chosen. If you choose CIF (Cost and Freight), then this usually involves delivery to the agreed port of destination, whereas if you choose DAP (Delivered At Place), then the goods will be delivered to the address specified in the sales contract.

Port of destination and customs clearance procedures

Incoterms can also be used to determine the port where the goods are to be delivered and the customs clearance procedures. If you choose FCA (Free Carrier), for example, this will usually indicate that the goods should be delivered to the agreed port and that the seller will have responsibilities for customs clearance.

How to choose the right Incoterms?

There are several factors to consider when making a choice:

- Main mode of transport: The main mode of transport is one of the main criteria to be considered as it may vary according to the Incoterm chosen;

- Responsibilities of the involved parties: You need to have a clear understanding of the responsibilities of the different parties involved so that you know who will pay for what;

- Place and port of destination: You must know the place and port where the goods will be delivered before choosing an Incoterm;

- Transfer of risks and costs: You need to know which party will be responsible for transferring the risks and costs of the goods.

Read also on the same subject

Overview of the concept of Incoterms

Benefits of Incoterms

Just like any other form of trade agreement, each type of Incoterm has its advantages:

- A better understanding between the parties of the obligations and responsibilities regarding the goods;

- Easier management of shipping costs;

- More accurate monitoring of international trade.

ASD Group assists companies in their international development with all customs and tax issues. To find out more, contact our experts!

Source: www.douane.gouv.fr (in French)