The European Commission invites companies to prepare for a “hard Brexit”

On 11 September 2018, the European Commission issued a notice in which it states that because of the great uncertainties about the content of an…

On 11 September 2018, the European Commission issued a notice in which it states that because of the great uncertainties about the content of an…

A company may post workers for a temporary mission to a country other than the one in which it is established. A posted worker is…

In a judgment of 27 June 2018, the CJEU (Court of Justice of the European Union) considered that in order to deny an enterprise the…

As an employer not established in Italy, when you send an employee to Italy for a temporary assignment, you do posting work in Italy.

When a company posts an employee to France, it has administrative duties to perform. Among its duties, is the duty of getting the clearance certificate…

As a reminder, an employer performing a secondment of its employees must declare it to the labor administration of the place where the service begins.

There are different customs procedures that allow companies to import and export to other countries without difficulty. Customs procedure 42 is the most common customs…

In France, as in many European countries, the posting of workers is highly regulated, and if you are an employer and second employees in another…

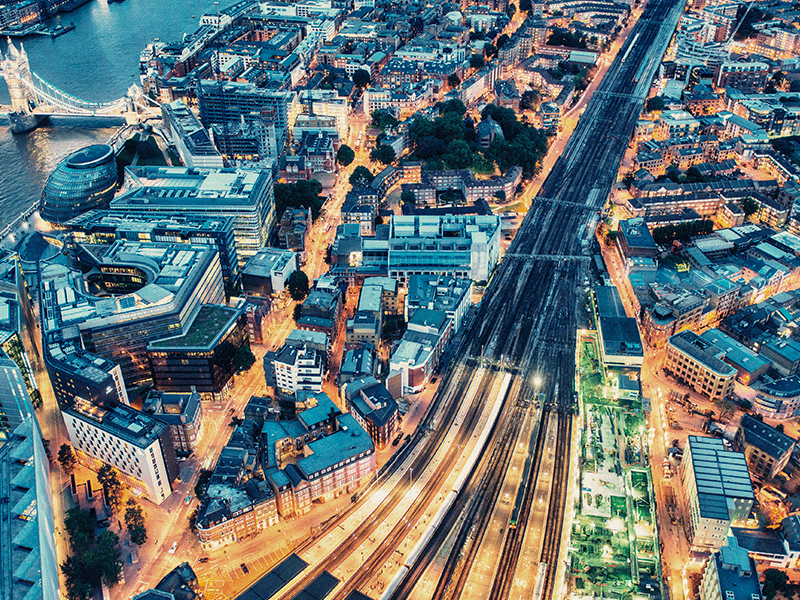

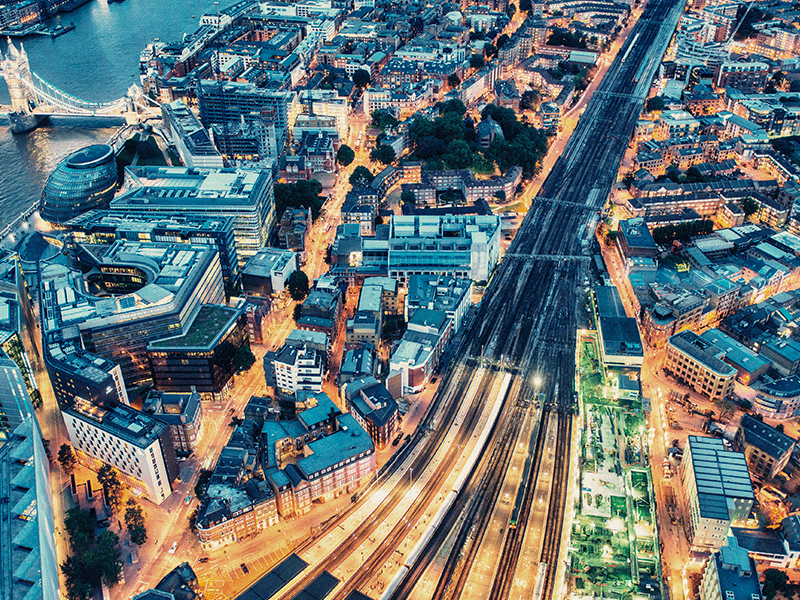

Brexit has changed the way exchanges are done between the UK and the EU. Here are the main changes. What is Brexit? January 31, 2020…

It is a transitional 25-year regime that will soon give way to measures significantly changing the rules on VAT. On 25 May 2018, the Commission…

The anti-pollution sticker aims to limit pollution in large cities. It classifies vehicles into 6 colours and levels according to their age and motorisation. Private…

The Internal Consumption Tax on Energy Products (TICPE) replaces the Internal Consumption Tax on Petroleum Products (TIPP).

The harvest season is coming and you want to hire foreign workers in France or Italy? This is obviously possible, and is called the posting…

The establishment of an invoice by a company requires the respect of European rules. In the event of errors in the invoices issued, the right…

A company not established in France that posts employees in France has declarative obligations, but also the obligation to keep documents to present in case…

Today, companies are more developing internationally. Expanding its market becomes important, to compete and gain a worldwide reputation.

Do you want to conquer new markets? The international development of your business requires some control of the regulatory aspects to be in compliance with…

The posting of foreign employees concerns companies that send one or more employees to perform a service in another country. Several sectors of activity have…

The “Incoterms” are set up by the International Chamber of Commerce. The term “Incoterms” means “Terms of International Trade” also translated “International Terms of Sale”….

The Trade of Goods Declaration is a mandatory declaration to be made each month to the customs service. Sanctions are provided in the event of…

E-commerce platforms responsibility for VAT payments progresses will be applied in all Member States of the European Union starting from January 1, 2021. If this…

The Internal Consumption Tax on Energy Products (formerly TIPP) is a tax levied on petroleum products as well as on energy products. Note that the…

VAT rates fall under the framework of the VAT directive of 28th November 2006. Because VAT has not been harmonised at the European level, every year the…

On 25 May 2018, the European Commission proposed a series of technical amendments aimed at introducing a definitive VAT system for intra-Community BtoB transactions. These…

Often overlooked, the Community customs warehouse regime can be of great benefit to importing companies for many reasons.

The professional identification card for construction workers (commonly known as the “BTP Card” ) has been mandatory since March 22, 2017.

In the Netherlands, foreign companies may appoint a tax representative for all their administrative processes with tax administrations. They can also benefit from the import…

Amazon, the undisputed giant of E-commerce and preferred platform for distance selling, now offers its professional sellers the “Fulfilled by Amazon-Pan-European” service.

In principle, companies must issue invoices for the services and products that they provide.

The Official State Gazette has published the Royal Decree 1075/2017 of 29 December 2017 which introduces amendments to a decree published a year earlier.

Commercial operations at the international level follow a particular codification. These are “Incoterms” set up by the International Chamber of Commerce. This means “terms of…

Carrying out international commercial transactions requires, under certain conditions and thresholds, establishment of a Declaration of Exchange of Goods / Intrastat.

The customs import value, determined by the application of one of the valuation methods, follows a specific regime. Indeed, this customs determination is an essential…

THE DEFINITION OF REVERSE CHARGE OF VAT The reverse charge of VAT due on import allows companies who have opted for its application, to report…

Italy is one of the major economic players in the European Union. Recently, various changes have been made to the VAT system in this country.

In order to harmonize customs legislation in Europe, the European Union has a special code, the Union Customs Code (UCC), which maintains the two modes…

Following the VAT Directive, when the company, subject to the VAT is not established in the member state where VAT is supposed to be paid,…

The VAT is subject to strict regulations. Regarding imports (trade of goods or services) from countries (or territories) outside European Union, taxation is carried out…

In its April edition, the IN ANTIPOLIS MAGAZINE dedicates 2 pages to the international growth of ASD Group and particularly the opening of a new branch…

Poland has amended the tax provisions for VAT declarations and payments from 1 July 2018. These amendments apply to Polish companies, but also to foreign…

The People’s Republic of China is the world’s leading exporter, ahead of the United States, it is also the country that exports the most to…

Tax representative or tax agent: which one do you need to appoint? Find it out in this article.

Trade in goods between European Union member countries follows a particular regime. Council Directive 2006/112 / EC of 26 November 2006 provides undertakings with a…

International VAT regime knows constant changes. Since some of these changes are very important, we will detail for you the main measures that have recently…

A proposal from the European Commission dated 18 January 2018 has been submitted concerning the setting of VAT rates by each of the Member States…

From what we know at present, the United Kingdom will leave the European Union at the end of March 2019, and thus become a “third…

Due to the expansion of international trade, VAT (or the Goods and Services Tax in some OECD countries) applied in 165 countries has become an…

In order to inform companies about the application of the Comprehensive Economic and Trade Agreement (CETA / CETA), the Quebec Federation of Chambers of Commerce…

When a foreign company sends one or several employee(s) in France, it has the obligation to appoint a French representative in France (Article L1262-2-1 of the…

In 2016, the Comprehensive Economic and Trade Agreement (CETA) between Canada and the European Union entered into provisional application. This is one of the most…