Facing the climate emergency and the rapid erosion of forests worldwide, the European Union has adopted Regulation (EU) 2023/1115 aimed at reducing the environmental impact of consuming products linked to deforestation. This regulation notably imposes a due diligence obligation on companies importing or marketing certain products in the EU.

In this article, we will explore in detail what the due diligence statement is, who is affected, what steps to take, and what impacts to expect for European companies and their partners.

What is the due diligence statement?

Due diligence (or due diligence in English) is a preventive process that requires economic operators to verify that the products they import or sell in the European Union do not contribute to deforestation or forest degradation.

It involves collecting, analysing, and retaining information to ensure the traceability of the products concerned from their origin to their placement on the European market.

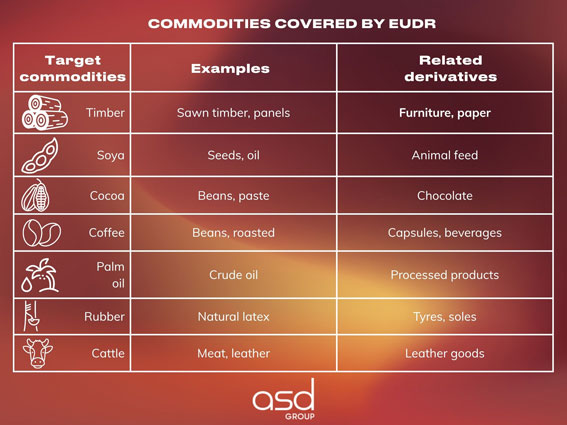

Products covered by Regulation (EU) 2023/1115

The regulation covers a range of products considered to be at high risk of contributing to deforestation:

| Targeted products | Examples | Related derivatives |

| Timber | Sawn timber, panels | Furniture, paper |

| Soya | Seeds, oil | Animal feed |

| Cocoa | Beans, paste | Chocolate |

| Coffee | Beans, roasted | Capsules, beverages |

| Palm oil | Crude oil | Processed products |

| Rubber | Natural latex | Tyres, soles |

| Cattle | Meat, leather | Leather goods |

The mentioned products are subject to due diligence only if they were produced after 31 December 2020.

Main objectives of the regulation

The European regulation against deforestation pursues several environmental and economic objectives:

- Preserve primary forests and natural ecosystems

- Reduce CO2 emissions linked to deforestation

- Improve transparency of supply chains

- Combat imported deforestation

- Hold companies accountable in the agri-food and forestry sectors

Key dates to remember

| Date | Event |

| 31 December 2020 | Production cut-off date for the products concerned |

| 29 June 2023 | Official publication of Regulation (EU) 2023/1115 in the OJEU |

| 30 December 2025 | Entry into force of the regulation for most companies |

| 30 June 2026 | Application for micro-enterprises and certain SMEs |

Companies concerned by the due diligence statement

The regulation applies to two types of economic operators:

| Category | Definition | Main obligations |

| Operators | Importers, exporters or manufacturers placing products on the market | Full due diligence |

| Traders | Entities that sell or distribute products downstream | Retention of information provided by operators |

SMEs are also affected, although some obligations may be eased.

Read on the same topic:

Due diligence statement (DDS) and deforestation: The EU strengthens its customs requirements

Steps of Due Diligence

Here are the three key steps to follow in the due diligence statement:

1. Information collection

The operator must collect precise data on:

- The type of product

- The country of production

- The geolocation of agricultural or forestry plots

- The volume, the supplier, customs documents

2. Risk assessment

The risk analysis must take into account:

- The risk level of the country of origin

- The track record of suppliers

- The complexity of the supply chain

The regulation provides for a classification of countries into three risk categories: low, standard, and high.

As part of the EUDR, the European Commission published on 22 May 2025 the very first list of countries classified according to their deforestation risk level (in French). This classification allows for adjusting due diligence requirements based on the level of risk identified for each country.

| Risk level | Required measures |

| Low | Simplified procedure |

| Standard | Full procedure |

| High | Enhanced controls, on-site verifications |

Countries classified as low risk

The countries classified as low risk are as follows:

Afghanistan, Albania, Algeria, Andorra, Antigua and Barbuda, Argentina, Armenia, Australia, Austria, Azerbaijan, Bahamas, Bahrain, Bangladesh, Barbados, Belarus, Belgium, Belize, Benin, Bhutan, Bosnia and Herzegovina, Brunei Darussalam, Bulgaria, Burkina Faso, Burundi, Cabo Verde, Cambodia, Cameroon, Canada, Central African Republic, Chad, Chile, China, Colombia, Comoros, Congo, Costa Rica, Côte d’Ivoire, Croatia, Cuba, Cyprus, Czechia, Djibouti, Dominica, Dominican Republic, Egypt, Estonia, Eswatini, Fiji, Finland, France, Gabon, Gambia, Georgia, Germany, Ghana, Greece, Grenada, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Honduras, Hungary, Iceland, India, Indonesia, Iran, Iraq, Ireland, Israel, Italy, Jamaica, Japan, Jordan, Kazakhstan, Kenya, Kiribati, Kuwait, Kyrgyzstan, Laos, Latvia, Lebanon, Lesotho, Liberia, Libya, Liechtenstein, Lithuania, Luxembourg, Madagascar, Malta, Maldives, Mali, Marshall Islands, Mauritania, Mauritius, Mexico, Micronesia, Monaco, Mongolia, Montenegro, Morocco, Mozambique, Myanmar, Namibia, Nauru, Nepal, Netherlands, New Zealand, Nicaragua, Niger, Nigeria, North Macedonia, Norway, Oman, Pakistan, Palau, Palestine, Panama, Papua New Guinea, Paraguay, Peru, Philippines, Poland, Portugal, Qatar, Republic of Korea, Republic of Moldova, Romania, Rwanda, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Samoa, San Marino, Sao Tome and Principe, Saudi Arabia, Senegal, Serbia, Seychelles, Sierra Leone, Singapore, Slovakia, Slovenia, Solomon Islands, Somalia, South Africa, South Sudan, Spain, Sri Lanka, Sudan, Suriname, Sweden, Switzerland, Syrian Arab Republic, Tajikistan, Thailand, Timor-Leste, Togo, Tonga, Trinidad and Tobago, Tunisia, Turkey, Turkmenistan, Tuvalu, Uganda, Ukraine, United Arab Emirates, United Kingdom, United States, Tanzania, Uruguay, Uzbekistan, Vanuatu, Venezuela, Vietnam, Yemen.

Countries classified as high risk

Several countries have been identified as high risk, leading to a complete ban on importing timber and its derivatives within the European Union.

- Belarus

- North Korea

- Myanmar

- Russian Federation

Countries classified as standard risk

Countries that are neither in the low-risk nor high-risk categories are automatically considered as presenting a standard risk.

In this case, economic operators are required to implement all due diligence obligations before placing their products on the European Union market.

Examples of standard risk countries:

- Brazil

- Cameroon

- Democratic Republic of the Congo (DRC)

- Côte d’Ivoire

Through regular exchanges between the countries concerned and the European Commission, as part of a structured dialogue, this classification may evolve over time.

3. Risk mitigation measures

In case of identified risks, the company must implement corrective actions:

- Change supplier

- Request additional audits or certifications

- Suspend market placement

Declaration and traceability in the European information system

From 30 December 2025, all operators must submit their due diligence statement in a centralised IT system managed by the European Commission, TRACES-NT.

Each declaration must include:

- Operator’s identity

- Information on the product and its traceability

- Results of the risk assessment

- Mitigation measures where applicable

The system will assign a unique identifier to each declaration, facilitating checks by customs authorities.

Penalties for non-compliance

Member States are responsible for applying effective, proportionate, and dissuasive penalties.

Penalties may include:

- Administrative fines (up to 4% of the company’s annual turnover)

- Confiscation of products

- Temporary import ban

Random checks will be carried out by competent national authorities to verify the compliance of declarations.

Impacts for European companies

Opportunities:

- Promotion of sustainable practices

- Better control of supply chains

- Preferential access to the European market in case of compliance

Challenges:

- Complexity of plot geolocation

- Increased administrative burdens

- Need to train staff and review purchasing processes

Best practices to adopt now

To anticipate the regulation’s requirements, companies can:

- Map their supply chain

- Select certified suppliers (FSC, RSPO, Rainforest Alliance…)

- Establish a reliable document management system

- Raise awareness among buyers and quality staff

Early compliance can provide a significant competitive advantage.

Practical cases: How to complete a standard declaration?

Here is an example of a simplified summary table:

| Element | Required information |

| Product | Cocoa beans |

| Origin | Côte d’Ivoire |

| Geolocation | Latitude/longitude of plantations |

| Production date | February 2024 |

| Volume | 12 tonnes |

| Supplier | Cocoa Ivoire Cooperative |

| Certification | Rainforest Alliance |

| Risk assessment | Standard risk |

| Measures | Third-party certification, supplier audit |

Sector focus: Which sectors are most impacted?

Timber sector

Highly affected by geolocation and forestry certification requirements (FSC, PEFC), the sector will need to strengthen traceability, particularly for imported furniture.

Agri-food sector (coffee, cocoa, palm oil)

Companies will need to prove that the raw materials used do not come from deforested areas. Partnerships with certified cooperatives will be essential.

Leather and beef sector

Traceability of cattle from pastures to the slaughterhouse must be demonstrated, a major logistical challenge for some long supply chains.

Recognised certifications and the role of labels

Certifications are not mandatory but provide significant proof of risk mitigation. Here are some examples:

| Certification | Sector | Main advantage |

| FSC | Timber | Sustainable forest management |

| PEFC | Timber | Certified traceability chain |

| RSPO | Palm oil | Sustainable and verified production |

| Rainforest Alliance | Cocoa, coffee | Strict social and environmental criteria |

Companies can combine certifications, internal audits and geographical data to ensure their compliance.

Regulation (EU) 2023/1115 marks a major turning point in the fight against imported deforestation. The due diligence statement becomes a central tool of European environmental policy, committing companies to take concrete action for the sustainability of forests.

Economic operators must start adapting now to these new obligations to avoid sanctions and market disruptions. Preparing their information systems, training their teams, and building long-term relationships with responsible suppliers will be key to ensuring compliance.

ASD Group assists you in the context of the EUDR

In response to the new requirements of Regulation (EU) 2023/1115, ASD Group supports businesses in ensuring compliance for their import or export operations involving products at risk of deforestation. Our experts assist you with entering the due diligence statement in the TRACES-NT system.

Thanks to our expertise in customs regulations, we ensure the customs compliance of your products within the European Union, while reducing your risk of penalties and customs clearance delays.

Feel free to explore all our customs solutions!

Get in touch with our experts now to anticipate your obligations, secure your imports, and ensure your products comply with the European regulation against deforestation.