United States: Landmark Supreme Court Decision on Customs Duties

The US Supreme Court has delivered a landmark decision for international trade. In the ruling Learning Resources, Inc. v. Trump of 20 February 2026, it...

The US Supreme Court has delivered a landmark decision for international trade. In the ruling Learning Resources, Inc. v. Trump of 20 February 2026, it...

Directorate Determination No. 84415 of 3 February 2026 introduces a major simplification of Intrastat obligations in Italy, particularly for the Intra 2-bis form relating to...

The French Customs (General Directorate of Customs and Indirect Taxes – DGGDI) issued an information note regarding the introduction of the small parcel tax, as provided for in...

The Finnish Parliament has approved a law reducing the reduced VAT rate from 14% to 13.5% as of 1st January 2026. This measure applies to...

We mentioned this in July 2025: the Deforestation Regulation (EUDR) was initially due to come into effect on 30 December 2025. This deadline has now...

As we previously announced, the Portuguese National Assembly confirmed on 27 November 2025 the approval of the 2026 State Budget, officially validating the postponement of...

In this article, we outlined the key dates to remember for the implementation of the EUDR. The Council of the European Union has now approved...

On 27 October 2025, the European Commission published a proposal authorising Italy to extend until 31 December 2028 the measure limiting to 40% the right...

Originally scheduled for 1 January 2025, the entry into force of the VAT chain in Belgium has finally been postponed indefinitely. This decision, announced by...

Since 1 January 2025, an amendment to the Value Added Tax (VAT) Act has come into force, also introducing a new rule concerning VAT deduction...

The Portuguese government has just submitted a new bill proposal as part of the State Budget for 2026. Among the new features (in particular Article...

Contrary to what we previously announced, the Obligatory Logistics Envelope (ELO), implemented as part of the Brexit smart border, will not become mandatory on 1...

On 27 July 2025, the European Union and the United States reached a last-minute strategic compromise, averting an unprecedented tariff escalation between the two blocs....

Businesses established in the European Union are entitled to a refund of the VAT they have paid in one of the 27 Member States of...

As we mentioned in the previous news on this subject, President Nicușor Dan has officially signed the new fiscal package, which notably includes the increase in VAT...

The French administration has announced a major change to the rules applicable to imports under the 4200 regime for DDP (Delivered Duty Paid) transactions carried...

The Romanian government has presented a draft bill aimed at reducing the budget deficit. The main tax measures, published on 3 July 2025, include: The...

The Canadian government has just announced the upcoming abolition of the Digital Services Tax (DST), with the aim of resuming bilateral trade negotiations with the...

To tackle the climate crisis and global deforestation, the European Union will enforce Regulation (EU) 2023/1115 from 30 December 2025 (or from 30 June 2026...

Businesses established outside the European Union are entitled to a refund of the VAT they have paid in one of the 27 Member States of...

In response to US President Donald Trump’s signature of two executive orders amending the US tariffs on steel and aluminium, which came into force on...

The Enveloppe Logistique Obligatoire (ELO) is a new feature introduced as part of the SI Brexit to facilitate the passage of goods across the cross-Channel...

On 10th February 2025, President Trump signed two decrees amending US tariffs on steel and aluminium (Section 232 of the Trade Expansion Act of 1962)....

US President Donald Trump has just signed an executive order imposing tariffs on imports from Canada, Mexico and China. At the same time, he has...

On 11 December 2024, the Estonian government approved the introduction of a temporary security tax (in force until the end of 2028) to develop Estonia’s...

On 11 December 2024, the Finnish Parliament passed Bill HE 141/2024, under which goods and services currently subject to a reduced VAT rate of 10%...

On 11 December 2024, the Senate of the Czech Republic approved an amendment to the Value Added Tax (VAT) Act. Among other things, this revision...

The Portuguese State budget proposal for 2025 (OE 2025) was presented to Parliament in October and approved. The obligation to associate a qualified digital signature...

Since 1 November 2024, the gross minimum wage (SMIC) in France has risen by 2%, from €11.65 to €11.88 an hour. This new hourly rate...

The UK government had announced a postponement of the deadlines for certain cross-border customs procedures in the post-Brexit context, effective from 1 January 2021. HM...

On 3 October, the Slovak National Council adopted an amendment to the VAT Act. This provides for an increase in the general VAT rate from...

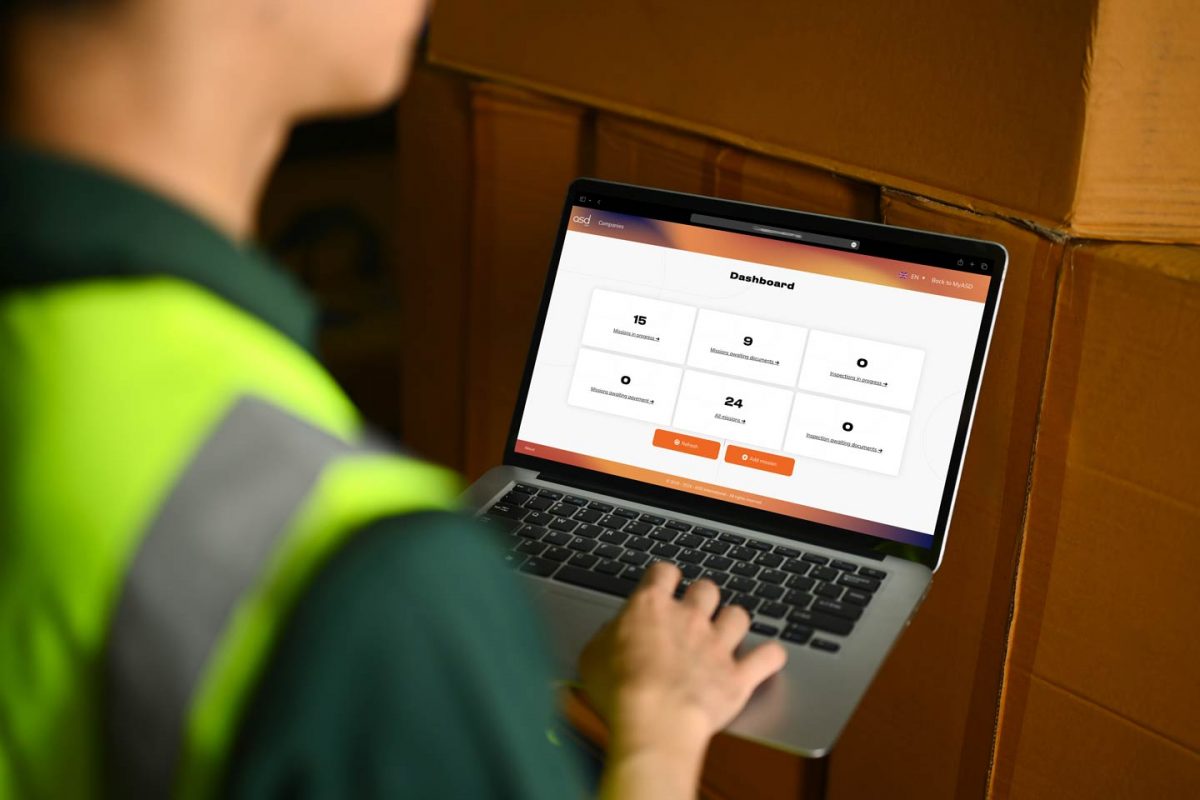

An even more powerful version for your secondment-related formalities! Discover a key update with a completely revamped interface and numerous new features that enhance your...

Companies in the European Union (EU) can obtain temporary suspensions of customs duties for raw materials or semi-finished products used in the manufacturing of finished...

From 1 October 2024, the reduced rate of VAT in the Autonomous Region of Madeira will be 4% (instead of the current 5%). This...

With the aim of digitising the Romanian tax administration, three emergency ordinances were published in the Official Journal on 21, 27 and 28 June 2024,...

On 28 June 2024, the Finnish Parliament passed Bill HE 61/2024, which increases the standard VAT rate from 24% to 25.5% with effect from 1...

Since 1 January 2024, a new law in Georgia has required retailers to collect tax on intrastate sales of products specifically downloaded digitally. This includes...

Within the European Union, goods from outside the EU must undergo customs formalities before they are allowed to enter. The Temporary Storage Facility allows imported...

Indiana recently abolished the transaction threshold for out-of-state sellers, i.e. those with no physical presence in the state. This major change, which will take effect...

On 13 March 2024, the European Parliament took a decisive step by adopting by a large majority the draft reform of the Customs Union. What...

Under Law 11/2021, the Spanish government has made it compulsory for companies to use approved Computerised Invoicing Systems (CIS) to combat tax fraud. The “VerifActu...

From 1 July 2024, Wyoming will drop its 200 annual transaction threshold for out-of-state sellers, i.e. those who have no physical presence in the state....

On 07 February 2024, the United Kingdom and Italy entered into a reciprocal agreement on VAT refunds with retroactive effect to 1 January 2021. As...

Introduced by law no. 2015-990 of 6 August 2015, the Professional Identification Card for employees in the construction and public works sector, known as the...

As a reminder, the Romanian Parliament adopted tax and budgetary measures including the introduction of compulsory electronic invoicing, which also applies to non-resident companies. The...

From 31 January 2024, the UK government has introduced a transition period to help overseas exporters familiarise themselves with the new regulations on plant health...

Businesses established in the European Union are entitled to a refund of VAT paid in any of the 27 EU Member States. This year, applications...

Businesses established outside the European Union are entitled to a refund of the VAT they have paid in one of the 27 Member States of...

The Carbon Border Adjustment Mechanism (CBAM) is a new regulatory instrument introduced by the European Union on 1 October 2023. The aim of this mechanism...

In accordance with their desire to comply with Regulation (EU) 2019/2152 of the European Parliament, the Latvian Statistical Office on the basis of paragraph 2...